Monetary Policy Framework

Putting the Bank of Mauritius Monetary Policy Framework and recent Key Rate changes into perspective.

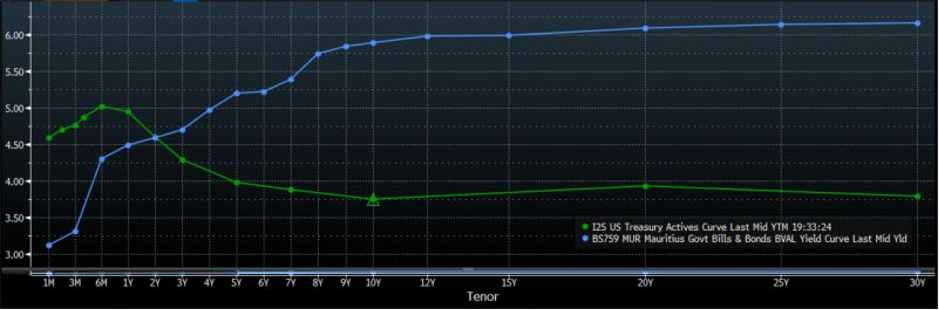

The combined effect of the change in the monetary policy framework and the recent changes in the key rate have led to an increase in long end yields (greater than 10yrs) of about 1.50% which is now significantly higher than the US yield curve and resulting in a significant policy tightening for Mauritian corporates that borrow long term.

The short end (less than 2yr) has also seen a sizeable rise in yields but remains well below the yields available on US government bonds. There is a reason for this – it is the new Monetary Policy Framework.

Personally, I doubt that this situation is going to change given that commercial banks have approximately MUR 50 billion of liquidity invested in 7 day T-bills.

Banks are therefore able to pay 2.90% to clients on their savings account and then invest the proceeds in a 7 day Tbill and earn 4.5% with no risk and the comfort of knowing that in 7 days their investment turns back into cash.

I would expect that the longer dated bond yields only start coming down when the savings rate paid by these banks increases and they are then forced to go into longer dated securities to earn their margin.

As for inflation, I believe the continued FX interventions by BoM will result in inflation coming back down over the next 6 months as we see the stable FX rate filter through to petrol prices etc.

#mauritianbondmarkets #mauritius #wealthmanagement #fixedincomestrategy

Talk to an advisor

Talk to an advisor